15+ automated loan decisioning

Key to the integration would be centralization of the loan decision-making process which was highly decentralized and lacked consistent underwriting guidelines. Apply Now With Quicken Loans.

Ex 99 2

Compare Mortgage Options Calculate Payments.

. When You Need It. A Guide to Implementing Automated Credit Decisioning Strategies. Automated loan decisioning is the process of using technology to speed up loan origination and improve decision-making.

When lenders automate gathering. Great Rates Backed by Rate Beat Program. In most cases auto-decisioning makes sense provided there is enough tracking measuring and monitoring in place to ensure that its working appropriately.

Ad Compare 2022s Best Merchant Cash Advance Loans Find the Best Option for Your Business. When executed properly automated loan decisioning software can offer credit unions many benefits including. A typical business credit assessment can be broken down into three steps.

The Benefits of Automated Loan Decisioning. Ad Rates with AutoPay. Ad Rates with AutoPay.

Here are the steps we usually advise when onboarding a new piece of lending software or upgrading a current system. Configure the thresholds used in decisioning. Ad Were Americas Largest Mortgage Lender.

Information about Lendsys loan decisioning software applications for banks. The automated small business loan underwriting solution will. Configure the metrics or ratios used to determine thresholds.

If Approved Use What You Need. Its ideal for banks and. Income verification for loan processing terms and conditions vary from lender to.

Ad Modernize your mortgage office and streamline your processes with Floify. With LendingTree we bring the lenders to you so you can find your best rate. Increased efficiency with better management and tracking of.

Information about Lendsys loan decisioning software applications for banks. Gather inferred data from third parties. Learn about our Rate Beat and Loan Experience Guarantee Now.

Loan decisioning software APIs can pull relevant data from third parties in a matter of minutes. Ad Start Shopping and Get Matched with Up to 5 Lenders Quickly. Lock Your Mortgage Rate Today.

Simply put automated loan processing and decisioning create a system that assesses relevant information and data related to the applicant allowing the lender to quickly. Chances are that you have. Great Rates Backed by Rate Beat Program.

Save time and upgrade your process with Floifys mortgage automation system. Identity resolution and verification. Select a Loan Purpose Now.

The breakdown for approval and denial rates within each type of decisioning are as follows. Fidelity Go Uses Smart Automation To Help Keep Your Investments On Track. With Zest lenders are able to make fast accurate and consistent credit decisions automatically allowing loan and underwriting teams to deliver exceptional service.

Depending on the loan departments policy they may even phone up the employer and ask for details. Learn about our Rate Beat and Loan Experience Guarantee Now. 6- 12- Or 18-Month Loan Term Options With Straightforward Monthly Fees.

23 auto-approved 73 auto-denied 43 manually approved and 267 manually denied. Easy access to credit is critical to any economic recovery but social distancing has brought new demand for online loans and automated credit decisioning. Ad Answer a Few Questions Well Build an Investment Strategy Based On Your Financial Goal.

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

Loan Decisioning Software For Accurate Decision Making Processes

Infosys Knowledge Institute The Future Of Lending Automated Risk Decision Making

Auto Decisioning For Commercial Loans A Good Thing For Community Banks Suntell

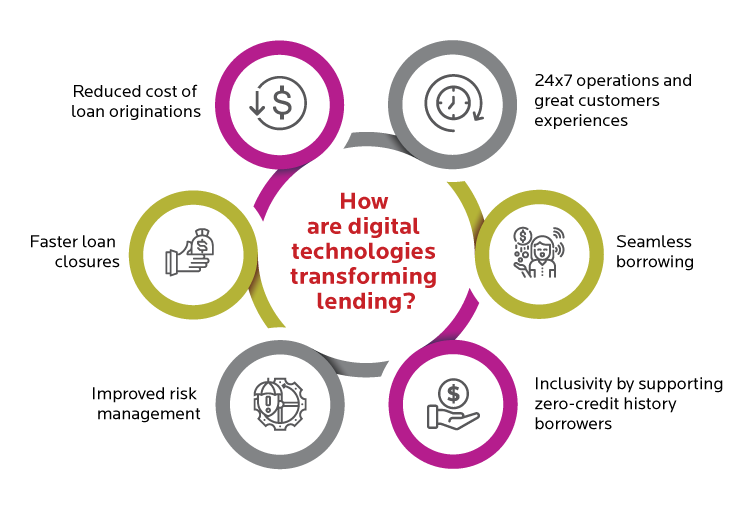

How Is Automated Credit Decisioning Transforming Digital Lending Birlasoft

Lending Credit Risk Software Solutions Abrigo

Digital Credit Assessment Management Digital Loan Origination System Corporate Lending

Auto Decisioning Is It Yes Or Is It No

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

Brankas Brankas Is Bringing Open Banking To Southeast Asia

How Automation Can Accelerate Loan Origination Process Akeo Lending

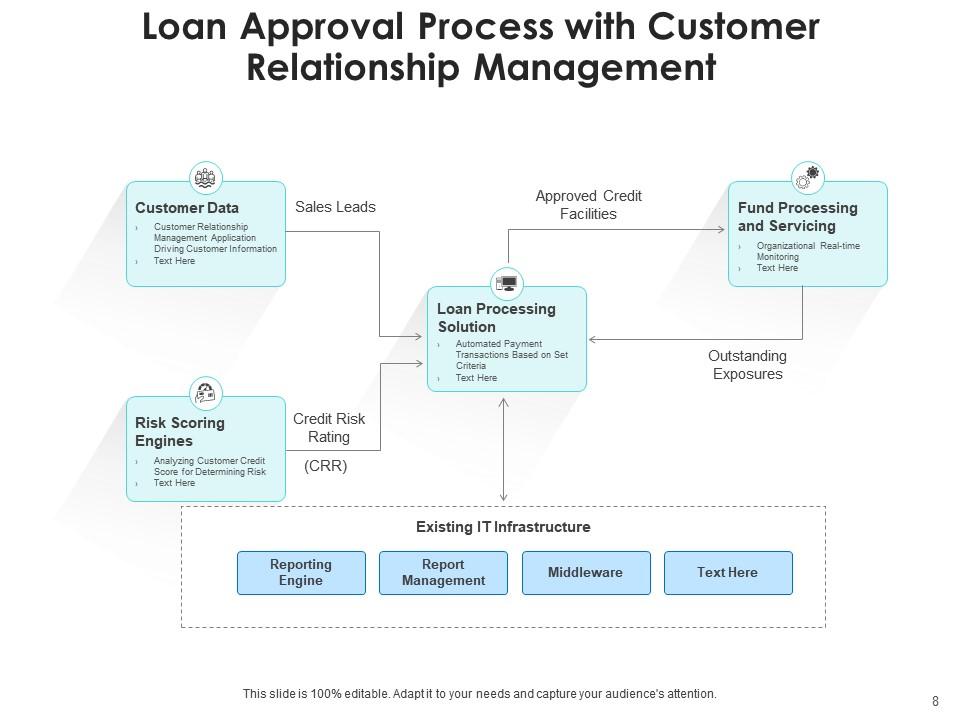

Loan Approval Process Customer Sales Management Risk Scoring Engines Presentation Graphics Presentation Powerpoint Example Slide Templates

Loan Portfolio Review Process Improvements Provision Estimation Due Diligence Presentation Graphics Presentation Powerpoint Example Slide Templates

Go Beyond Manual Loan Processing With Lending Automation Ocrolus

How Is Automated Credit Decisioning Transforming Digital Lending Birlasoft

Improving The Quality Of Credit Decision Stage With Decision Automation

Technology Optimizes The Loan Origination Process For Financial Institutions Idc Blog