31+ cash coverage ratio calculator

Debt Service Principal payments during the year Interest expenses 45000 20000 65000. Interpretation of Debt Service Coverage.

Answers To Cfa Level I Practice Problems Did You Crack Them The Princeton Review

Calculate average current liabilities.

. Web Step 1. Ad Enhance your Website with TCalc Financial Calculators. Web All you have to do is take the Cash and Cash Equivalents line from the assets side the most recent year and divide it by the line on the liabilities side of the balance sheet titled.

It is how you can measure a. Web Debt Service Coverage Ratio Formula. Web Coverage Ratio.

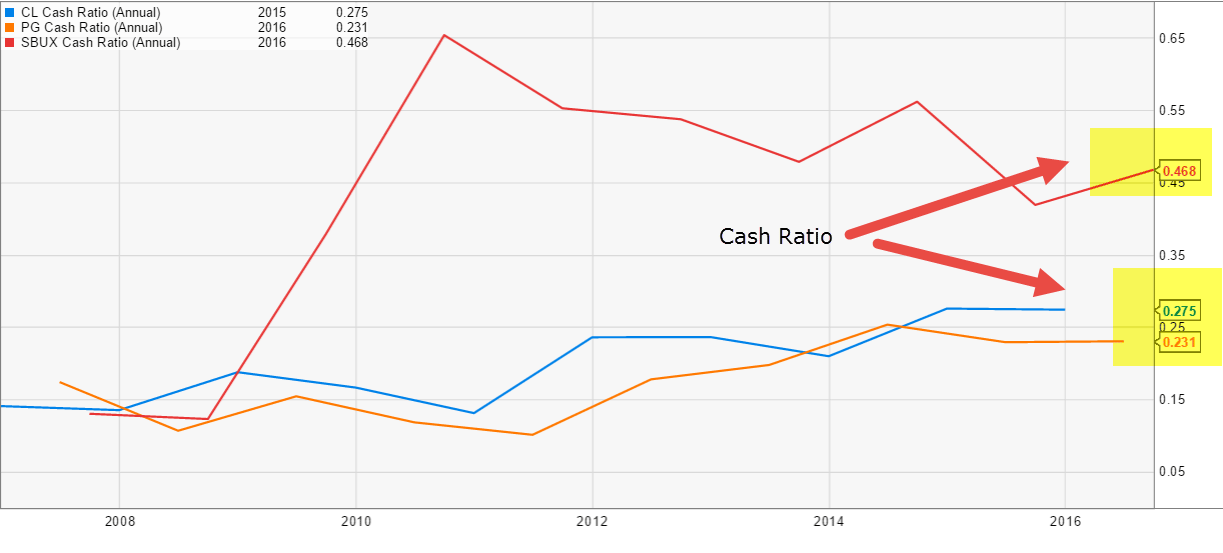

In broad terms the higher the coverage ratio the better. First well take the net income amount of 91000 and. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

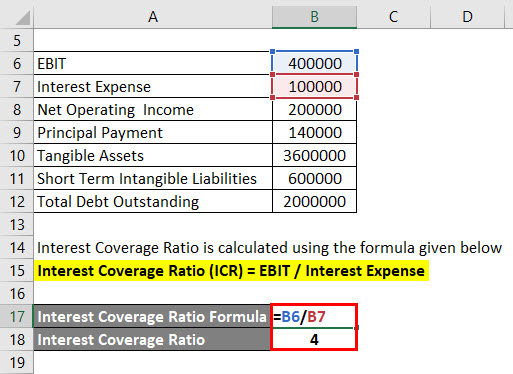

Help your customers answer their personal financial questions from your website. The interest coverage ratio is a debt ratio and profitability ratio used to determine how easily a company can pay interest on its. The only difference is that it takes the companys current liabilities into account instead of the total debt.

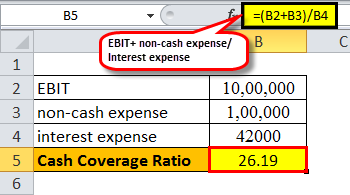

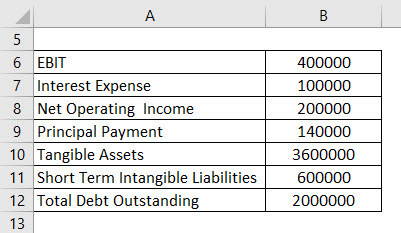

Web Lets go ahead and calculate the cash coverage ratio using the numbers from the income statement above. Web Interest Coverage Ratio. Debt Service Coverage is usually calculated using EBITDA as a proxy for cash flow.

Get an estimate now. Web Formulae Total Cash Available With The Brand Current Liabilities Cash Coverage ratio Step-3- Analyze The Calculation. You can sell your policy for much more than your life insurance company is telling you.

Adjustments will vary depending on. Web Based on this information ABC has the following cash coverage ratio. Current cash debt coverage.

Apply the given figures to the current cash debt coverage ratio. Web The coverage ratio calculator exactly as you see it above is 100 free for you to use. If you want to customize the colors size and more to better fit your site then pricing starts.

Consider a company with the following information. Ad Your life insurance policy is worth 4X more than theyre telling you. Find A Dedicated Financial Advisor Now.

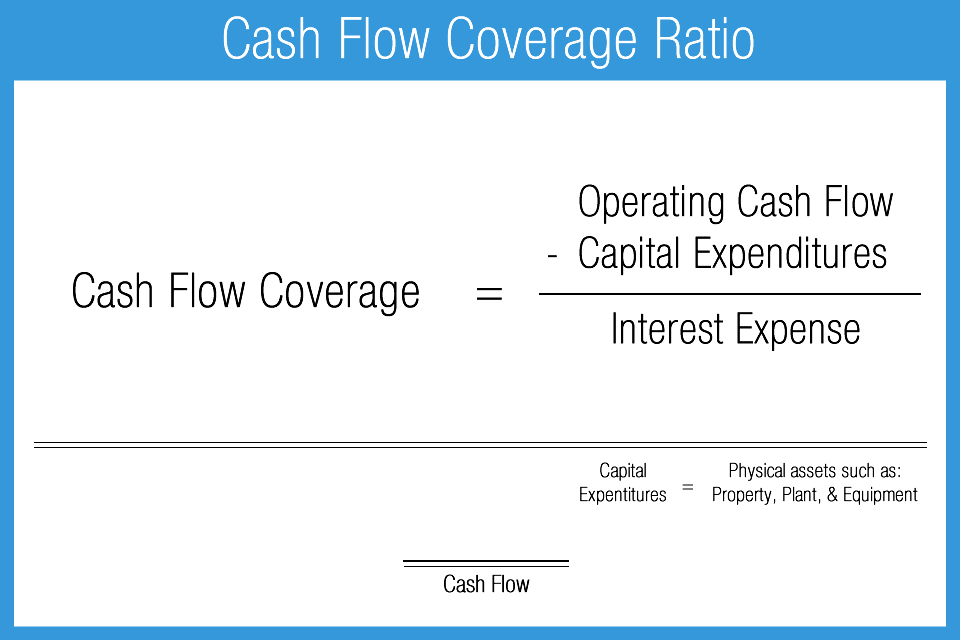

Web The cash coverage ratio is a calculation that determines a businesss ability to pay off its liabilities with its existing cash. 1200000 EBIT 800000 Depreciation 1500000 Interest Expense 133. Web This ratio formula is similar to that of the cash flow to debt ratio.

Web Cash coverage ratio Total cash Total interest expense. Additionally a more conservative approach is used to verify so the credit analysts calculate again using. Web The cash ratio formula divides a companys total cash-on-hand and any assets that can be immediately converted into cash by its current liabilities as follows.

The coverage ratio is a measure of a companys ability to meet its financial obligations. After you get the figure of the cash. Create an interactive experience.

Do Your Investments Align With Your Goals. Web Cash flow coverage ratio 80000000 38000000 2105.

Cash Ratio Or Cash Coverage Ratio Ccr Ratiosys

Cash Ratio Calculator

Coverage Ratio What Is It Formula Calculation Examples

Current Cash Debt Coverage Ratio Formula Example

Calculating Cash Flow Coverage Ratio In Excel Youtube

Cash Coverage Ratio Calculator Calculator Academy

Coverage Ratio Formula How To Calculate Coverage Ratio

Descriptive Statistics Of Interest Cover Ratio And Cash Interest Download Table

Cash Ratio Definition Formula How To Interpret

Research Study Options Challenges To Financing The Coal Transition In Spipa Countries By Climate Company Issuu

Times Interest Earned Ratio Explained Formula Examples

Cash Flow Coverage Ratio Eanaliza Pl

Cash Coverage Ratio Calculator Calculator Academy

Hockey Guide Pdf

Cash Coverage Ratio Carunway

What Is Cash Coverage Ratio How To Calculate It

Coverage Ratio Formula How To Calculate Coverage Ratio